Education, Strategy, Leadership

What makes Clinton different is what he teaches people behind the numbers. It’s not just about dumping CSVs into software and hoping for the best. Clinton is an educator at heart, whether he’s speaking to an audience of DeFi traders, podcast listeners, or a worried investor on a late-night Zoom call.

His podcast, The Clinton Donnelly Show, is where that comes alive. He’s not afraid to break down dense tax policy in plain English. Take his recent episodes on repealing the DeFi broker rule, he unpacked exactly why that matters to regular investors, and how the IRS is likely to pivot.

When Puerto Rico’s 0% crypto tax myth started grabbing headlines, Clinton recorded an entire series explaining who actually qualifies, the traps no one talks about, and how to protect yourself if you make the move.

One Trustpilot reviewer wrote: “I learned more from Clinton’s podcast in two episodes than I did in 10 calls with my old CPA. He makes this stuff make sense.” Another shared: “They’re the only ones who could explain staking taxes without sounding like robots.”

What people really appreciate is that Clinton gives them a roadmap not just for filing taxes once, but for staying audit-ready every single year. From the “Bulletproof Crypto Tax Return” method to his Safe Harbor strategies for traders with DeFi income, Clinton’s firm keeps refining what it means to be ahead of the IRS.

This isn’t static. The team studies every new IRS form, proposed rule, and court case so they can adjust the strategy before the agency makes the next move.

A client named Marie put it best in her review: “It feels like they’re already thinking 10 steps ahead for me. I don’t have to stress about that letter from the IRS anymore.”

"CryptoTaxAudit combines legal authority, technological sophistication, and personalized service to form a shield validated through courtroom victories, expert filing processes, and proactive defense programs."

— Financial Services Review

Read the full article

A Team Effort

Of course, Clinton doesn’t do it alone. He’s quick to credit the people around him: Kent, Director of Customer Solutions, is often the first reassuring voice a new client hears when they call in worried about an IRS letter. Ben, the firm’s Director of Crypto Analytics, is the numbers wizard who lives knee-deep in blockchain forensics and transaction tracing. Sarah, the Director of Tax, reviews complex returns and keeps the team sharp when new compliance challenges pop up.

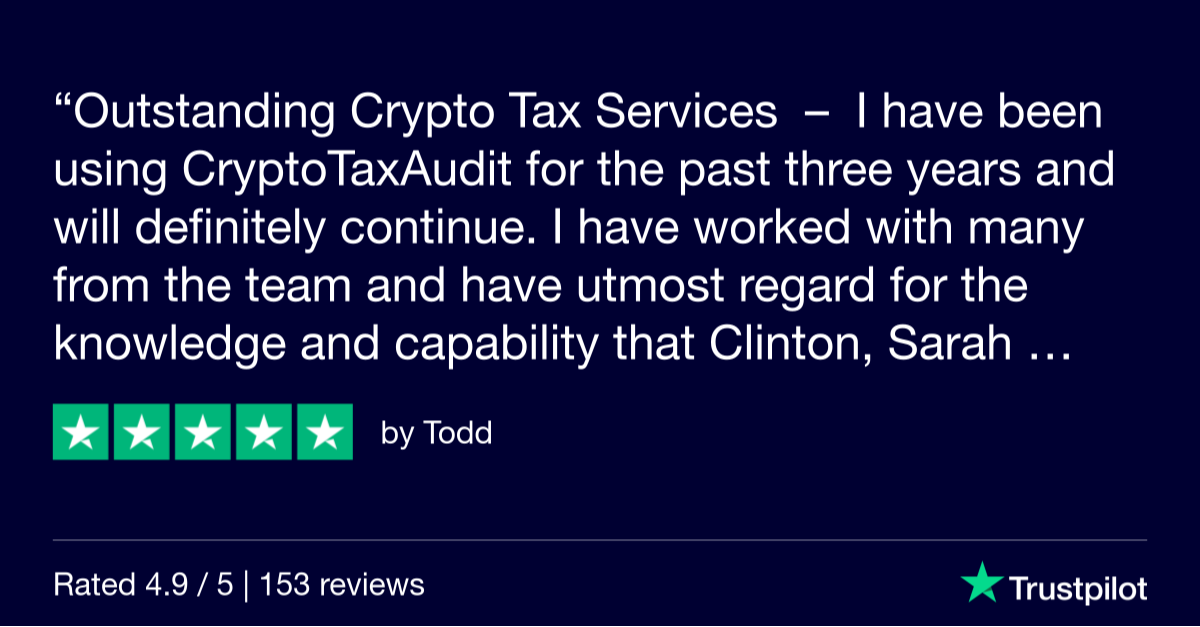

This collaborative spirit is part of why so many clients stick around year after year. “They treat me like a person, not a case file,” says Tom, another Trustpilot reviewer who’s been with the firm since 2019. “They actually care if you understand what’s happening.”

Where It’s All Going

If you ask Clinton what’s next, he’ll tell you this fight is far from over. The IRS keeps expanding its digital asset division, new 1099-DA reporting rules are around the corner, and enforcement actions are ramping up. His roadmap for the future includes more education, more transparent resources for clients, and tools that ordinary crypto traders can use to stay out of trouble.

“We want people to feel empowered, not intimidated,” Clinton says. “The crypto world moves fast, but that doesn’t mean you have to live in fear of a letter in the mailbox.”

So whether you’re an everyday HODLer, a DeFi degen with thousands of trades, or a high-net-worth expat managing complex offshore holdings, Clinton Donnelly is still the name insiders trust to keep them protected, informed, and confident.