U.S. Expats in Portugal: Do You Still Owe Crypto Taxes?

Key Takeaways:

- U.S. citizens must report worldwide income, including crypto, no matter where they live.

- Good News: Taxes on income paid to a foreign country are credited against your US taxes, so you won't have to pay twice.

- Bad News: The IRS has extra time, ten years, to audit a tax return filed while overseas.

- Portugal’s NHR regime offers favorable tax treatment, especially for long-term crypto holders.

- Crypto-to-crypto trades held over a year may be tax-free in Portugal but not in the U.S.

- Stablecoin cash-outs can avoid Portuguese tax, but are still reportable to the IRS.

- Crypto investors abroad should plan for dual compliance with both U.S. and local laws.

U.S. Citizens Abroad: You’re Still on the IRS Radar

Thinking about relocating to Portugal to enjoy crypto tax breaks under the NHR (Non-Habitual Resident) program?

You’re not alone. But here’s the part most expats miss: If you’re a U.S. citizen, you’re still required to report and potentially pay tax on your worldwide income, including crypto gains.

That’s right. Even if you never set foot in the U.S. again, Uncle Sam still wants a piece of your profits.

Why the U.S. Is Different

Most countries stop taxing you when you leave.

The U.S.? It doesn’t care where you live, what passport you hold, or which exchanges you use. If you're a U.S. citizen, the IRS expects full disclosure whether you’re trading on Coinbase or a DEX in Portugal.

Crypto, real estate, stocks it’s all fair game.

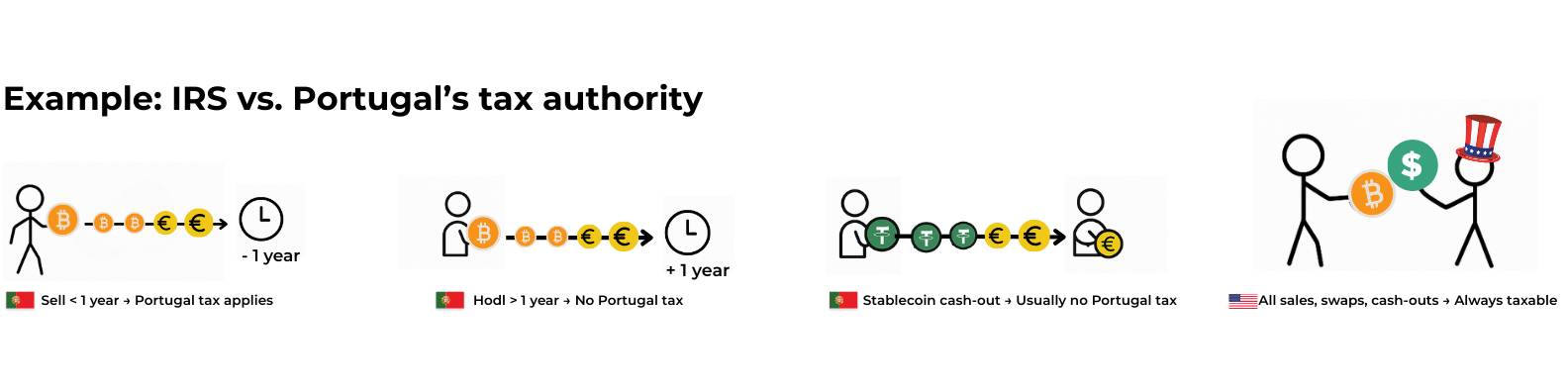

How Portugal Taxes Crypto (and Where It Differs)

Portugal's NHR regime is appealing for crypto investors because of how it treats certain types of gains:

- Crypto-to-crypto trades are not taxable if held for more than a year.

- Crypto sold in under a year may trigger tax in Portugal.

- Crypto-to-fiat (like stablecoin to euros) may be taxable but stablecoin-to-fiat usually isn’t.

So, the typical tax-minimizing strategy in Portugal looks like this:

- Hold assets for over a year.

- Convert to stablecoins (like USDC or USDT).

- Cash out the stablecoins for fiat, ideally triggering no Portuguese tax.

*But remember this only applies in Portugal.

The IRS doesn’t care if you held an asset for one year or ten. If you sell it, it's taxable.

U.S. Rules Always Apply

Even if Portugal lets you off the hook, the IRS doesn’t.

That’s why the safest route is to report all crypto transactions on your U.S. tax return, regardless of whether Portugal taxes them or not. The IRS has become aggressive about tracing crypto activity and U.S. citizens remain high-priority targets.

Local Help in Portugal

Need help managing your Portuguese crypto taxes? Thomas Maas is a trusted local expert who specializes in helping expats optimize for Portugal’s system. He understands the nuances of the NHR regime and can help you stay compliant while minimizing your tax exposure.

Just don’t assume Portugal’s tax benefits automatically translate into U.S. savings. They don’t.

Final Word

If you’re a U.S. expat living in Portugal or planning to be, crypto tax compliance is a two-front battle.

The good news? You don’t have to face it alone.

At CryptoTaxAudit, we specialize in defending U.S. citizens with international crypto exposure.

Whether you're optimizing your strategy, cleaning up past filings, or preparing for an audit, we’re here to help.

Related Article: The New Broker Dealer Rule: What It Means for Crypto Taxes in 2025¹

FAQ: Crypto Tax for U.S. Expats in Portugal

Do U.S. expats still owe crypto taxes while living in Portugal?

Yes. U.S. citizens must report and pay taxes on their worldwide income, including crypto, even if they live abroad.

Is Portugal a crypto tax haven?

Partially. Under the NHR regime, long-term crypto holdings may be tax-free in Portugal. But this doesn’t affect your U.S. obligations.

Can I exclude foreign crypto income on my U.S. tax return?

No. There’s no exclusion for foreign crypto gains. All crypto transactions must be reported on your U.S. tax return even if Portugal doesn’t tax them.

Can I skip reporting to the IRS if Portugal doesn’t tax it?

No. The IRS still requires full reporting of crypto activity, regardless of how Portugal treats it.

👉 Stay IRS-compliant no matter where you live. Visit CryptoTaxAudit.com to get expert help with your international crypto strategy.