The New Broker Dealer Rule: What It Means for Crypto Taxes in 2025¹

By Clinton Donnelly, CEO, Founder | CryptoTaxAudit

Key Takeaways:

- The Broker Dealer Rule now applies to U.S.-based crypto exchanges like Coinbase, Kraken, Gemini, Uphold, Swan, and Robinhood.

- Exchanges will issue Form 1099-DA with sell/exchange details similar to a stockbroker’s 1099-B.²

- Starting in tax year 2026, exchanges will report the cost basis, holding period, and gain/loss.

- Starting in tax year 2026, transfers into and out of exchanges will be reported to the IRS, including wallet addresses.³

- A December 2024 attempt to expand the rule to DeFi developers was struck down in Congress, a rare IRS defeat.⁴

For tax year 2025, a major tax law change is reshaping how your crypto trading activity is reported and the IRS will be watching closely.

Here’s what you need to know about the new Broker Dealer Rule and how it could impact your reporting obligations. The new regulations are so extremely complicated that I’ve added footnotes to provide additional precision to avoid making the article complex.

What Is the IRS Broker Dealer Rule for Crypto Exchanges?

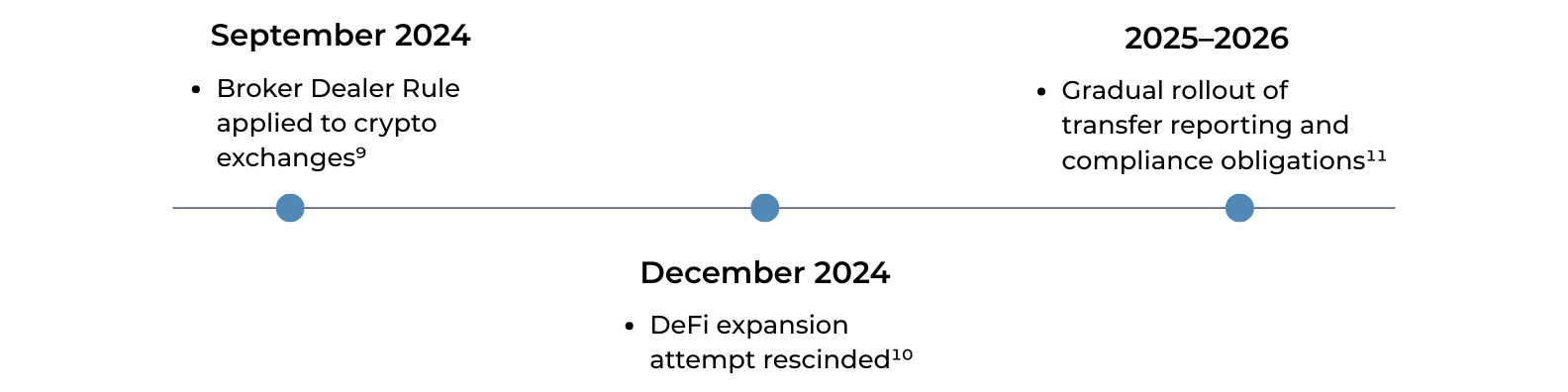

The Broker Dealer Rule historically applied to traditional brokerages. Now, under IRS regulations that took effect in September 2024, it also covers crypto exchanges and certain trading platforms.⁵

This means they must:

If all your trading occurs on a single exchange, this could simplify your tax reporting. But once you move assets between platforms or wallets, your cost basis tracking becomes more complex, and the IRS's visibility into your activity increases.

If all your trading occurs on a single exchange, this could simplify your tax reporting. But once you move assets between platforms or wallets, your cost basis tracking becomes more complex, and the IRS's visibility into your activity increases.

How Will 1099-DA Transfer Reporting Affect Crypto Traders in 2026?

Starting for tax year 2026, exchanges will also report non-trade transfers.⁷

If you send assets into an exchange, the IRS will see:

*This applies even if the transfer isn’t a taxable event, giving the IRS a detailed ledger of wallet activity, especially when moving between fiat on/off ramps.

*This applies even if the transfer isn’t a taxable event, giving the IRS a detailed ledger of wallet activity, especially when moving between fiat on/off ramps.

Why Did the IRS Fail to Apply the Broker Dealer Rule to DeFi in 2024?

In December 2024, the IRS attempted to extend these rules to include:

- DeFi protocol developers

- Server operators running DeFi code

This sparked bipartisan pushback. Senator Ted Cruz led a successful challenge in Congress, resulting in the first rescission of IRS regulations in history.⁸

Donald Trump signed the act, marking a rare public rebuke of IRS overreach.

This rescission prevents the IRS from making similar regulations in the future.

Key IRS 1099-DA Reporting Dates Crypto Traders Must Watch (2024–2026)

WhatWhat Should Crypto Investors Do Now to Prepare for IRS 1099-DA Rules?

- Consolidate trading activity where possible to simplify cost basis reporting.

- Keep meticulous records of all trades and transfers, especially between exchanges and wallets.

- Understand that IRS tracking capabilities are expanding even for non-taxable transfers.

- Stay informed on rule changes through trusted sources like the IRS Digital Assets page.

Related Article: Did the IRS Really Delay Crypto Tax Reporting to 2026? Unpacking the Truth

Frequently Asked Questions About the Broker Dealer Rule

Q: What exactly is Form 1099-DA, and when will I get one?

A: Form 1099-DA is a new tax form exchanges must issue to report your crypto transactions, including purchase and sale details. You’ll receive it for an activity that happens on that exchange starting in 2025.¹²

Q: Will the IRS see my self-custody wallet addresses?

A: Yes. Under the Broker Dealer Rule, exchanges will report the wallet address that sent or received assets during transfers even if the transfer isn’t taxable.¹³

Q: How can CryptoTaxAudit help me with these changes?

A: We specialize in gain calculations, IRS account monitoring, and audit defense for crypto investors. We ensure your cost basis is correct, your records are audit-ready, and you’re fully prepared for the increased IRS scrutiny these rules bring.

Protect Yourself Before the IRS Comes Calling

At CryptoTaxAudit, we help serious crypto investors:

- Rebuild and verify cost basis across multiple wallets and exchanges

- Prepare for IRS scrutiny with bulletproof records

- Defend your position in the event of an audit

Don’t wait for the IRS to knock. Visit CryptoTaxAudit.com today and get protected.

Footnotes:

¹ The term "Broker Dealer Rule" is informal; the applicable regulations are the digital asset broker information reporting requirements under section 6045 of the Internal Revenue Code, as implemented by Treasury Decision 10000.

² Form 1099-DA reports gross proceeds from digital asset dispositions for the 2025 tax year; details like cost basis are voluntary until mandatory for certain assets in 2026 (Treasury Decision 10000).

³ Brokers report dispositions (sales or exchanges) to the IRS on Form 1099-DA, not all transfers. Wallet addresses are reported on Form 1099-DA for dispositions starting in 2026. For transfers, brokers furnish transfer statements to receiving brokers, but these are not directly reported to the IRS (Treasury Decision 10000).

⁴ The IRS finalized regulations for DeFi brokers on December 30, 2024, which were later overturned by a Congressional Review Act resolution signed by President Trump on April 10, 2025 (not in December 2024).

⁵ The final regulations (Treasury Decision 10000) were published on August 29, 2024, and apply to dispositions on or after January 1, 2025.

⁶ For 2025, Form 1099-DA requires reporting of gross proceeds and sale date; basis (purchase price) is voluntary until 2026 for covered securities (Treasury Decision 10000).

⁷ Non-trade transfers are not reported to the IRS; however, for sales of transferred-in assets, certain transfer details may be included on Form 1099-DA. Transfer statements are provided between brokers for basis tracking starting in 2026 (Treasury Decision 10000).

⁸ This rescission occurred on April 10, 2025, following the finalization of the DeFi regulations on December 30, 2024, via a Congressional Review Act resolution led by Senator Ted Cruz and signed by President Trump.

⁹ The regulations were published on August 29, 2024, and became effective for transactions starting January 1, 2025 (Treasury Decision 10000).