Why Do Long-Term Crypto Holders Pay Capital Gains Tax on Inflation?

Key Takeaways

- Capital gains tax often charges you on inflation, not real profit.

- The current system doesn’t index gains to inflation, inflating your tax bill.

- Other countries offer 0% tax on assets held over a year a model worth considering for U.S. crypto investors.

- The $3,000 capital loss limit hasn’t been adjusted since 1986, making it outdated and inadequate.

Long-term crypto investors are getting hit with a tax most people don’t realize is fundamentally unfair.

Here’s why capital gains tax is really a tax on inflation, and what needs to change.

Why Capital Gains Tax Is a Tax on Inflation

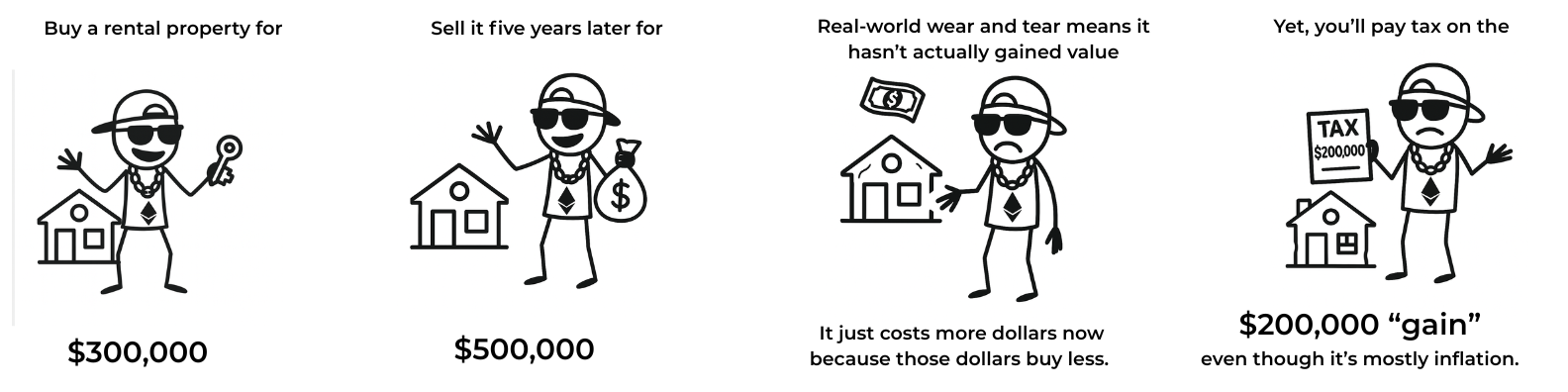

When you earn a salary, rental income, or royalties, you’re paid in today’s dollars.

Capital gains tax is different it compares today’s sale price to the purchase price from years ago, without adjusting for the fact that dollars lose value over time.

Example:

The same logic applies to crypto. If you bought Bitcoin at $10,000 and sell years later for $1,000,000, much of that price jump reflects the declining value of the dollar, not just the asset’s performance.

Why This Hits Crypto Investors Hard

Crypto HODLers take all the risk — market volatility, emotional stress, and long holding periods — but the IRS can still take 20–24% of your “gain” through capital gains tax and the Net Investment Income Tax (NIIT).

And unlike wages, there’s no inflation adjustment for long-term investments.

Possible Fixes for a Broken System

Index Gains to Inflation

Some tax reform proposals suggest adjusting the taxable amount based on inflation, so you’re only taxed on real profit.

The challenge: trusting the IRS to set a fair inflation rate.

0% Long-Term Capital Gains After One Year

Many European and Asian countries don’t tax assets held for more than 12 months.

This encourages stability and long-term investment, something U.S. policy could benefit from.

Update the $3,000 Loss Limitation

Set in 1986, the annual capital loss deduction cap has never been adjusted for inflation.

If it kept pace with economic changes, it could be $20,000–$50,000 today, a meaningful relief for smaller investors.

For IRS reference: Topic No. 409 Capital Gains and Losses

Why This Matters in 2025

With tax reforms like the proposed Digital Asset Tax Legislation under discussion, now is the time to push for fairer treatment of long-term crypto holders.

If policymakers want to stimulate domestic investment and strengthen the U.S. economy, fixing the capital gains tax should be part of the conversation.

Related Article: Is a 0% Crypto Tax Possible? How It Could Reshape the U.S. Economy —

Frequently Asked Questions About Capital Gains and Crypto

Q: How does capital gains tax apply to crypto?

A: The IRS treats crypto as property, meaning you owe capital gains tax when you sell, trade, or dispose of it. The gain is calculated from your cost basis, but no inflation adjustment is applied.

Q: Why is the $3,000 capital loss limit outdated?

A: Because it was set in 1986 and never indexed to inflation. In today’s economy, $3,000 offers minimal relief, especially for active crypto investors.

Q: How can CryptoTaxAudit help me reduce my capital gains burden?

A: We help investors calculate accurate gains, identify overlooked deductions, and defend against IRS overreach. With cost basis reconstruction, audit defense, and IRS monitoring, we make sure you keep more of your gains.

Protect Your Gains Before the IRS Takes a Cut

At CryptoTaxAudit, we help serious crypto investors:

- Rebuild accurate cost basis records

- Defend against IRS audits and aggressive tax positions

- Monitor your IRS account for early warning signs

Don’t wait until tax time, visit CryptoTaxAudit.com today and protect what you’ve earned.