The Complete Crypto Tax Compliance Guide for Investors and Traders

By Clinton Donnelly, CEO, Founder | CryptoTaxAudit

The IRS uses multiple methods to detect unreported cryptocurrency transactions. These systems work together to build a view of taxpayer activity across exchanges, wallets, and blockchain networks.

Unreported crypto income over $10,000 can result in civil penalties. Willful failure to report may lead to criminal charges.

Guide Sections

The IRS uses the following methods to track crypto activity:

- Form 1099-DA reporting: Beginning with the 2025 tax year, U.S. exchanges must report your crypto sales and proceeds directly to the IRS. Coinbase, Kraken, and Gemini will issue these forms to taxpayers. The first reports will show gross proceeds only; cost basis reporting may be added in subsequent years.

- Blockchain forensics: When you transfer crypto between an exchange and an external wallet, the exchange records your blockchain address. The IRS can use forensic tools to trace activity across that address including transactions through DeFi platforms or self-custody wallets.

- AI-powered analysis: The IRS has contracted with Palantir Technologies (at a reported cost of $99 million) to develop systems that identify potential underreporting. These tools analyze trading patterns, social media activity, and other available data to flag returns for review.

- John Doe summons: Federal courts have granted the IRS authority to request customer records from exchanges without specifying individual names. The agency used this mechanism to obtain records from Coinbase, Kraken, and other platforms.

- Crypto-Asset Reporting Framework (CARF): The OECD developed the Crypto-Asset Reporting Framework to enable automatic exchange of cryptocurrency transaction data between participating countries. The U.S. Treasury Department has submitted CARF regulations to Congress and the White House for approval.

- Current status: As of January 2026, this framework remains under review and has not been implemented. If approved, CARF would allow tax authorities to share crypto transaction data across borders, potentially including countries like the U.K., Australia, Canada, and the Netherlands.

PART 1: THE NEW 1099-DA REPORTING REQUIREMENT

Section 1.1: Understanding Form 1099-DA: Digital Asset Reporting Requirements

Beginning with the 2025 tax year, U.S. cryptocurrency exchanges must issue Form 1099-DA to taxpayers. Coinbase, Kraken, Gemini, and Robinhood are among the platforms required to send this form.

DA stands for "Digital Assets." The form reports digital asset taxable events to the IRS, similar to how other 1099 forms report income and transactions.

Form 1099-DA captures sales and transfers, but not purchases, which are not taxable events. If you sold or moved crypto off a centralized U.S. exchange during the tax year, you will receive this form.

What Information Appears on Form 1099-DA

Form 1099-DA provides the IRS with:

- Every crypto sale you execute on the platform

- Every transfer you initiate to an external wallet

- The wallet address where you sent funds

- The asset type and its value at the time of sale or transfer

How Missing Cost Basis Creates Tax Liability Risk

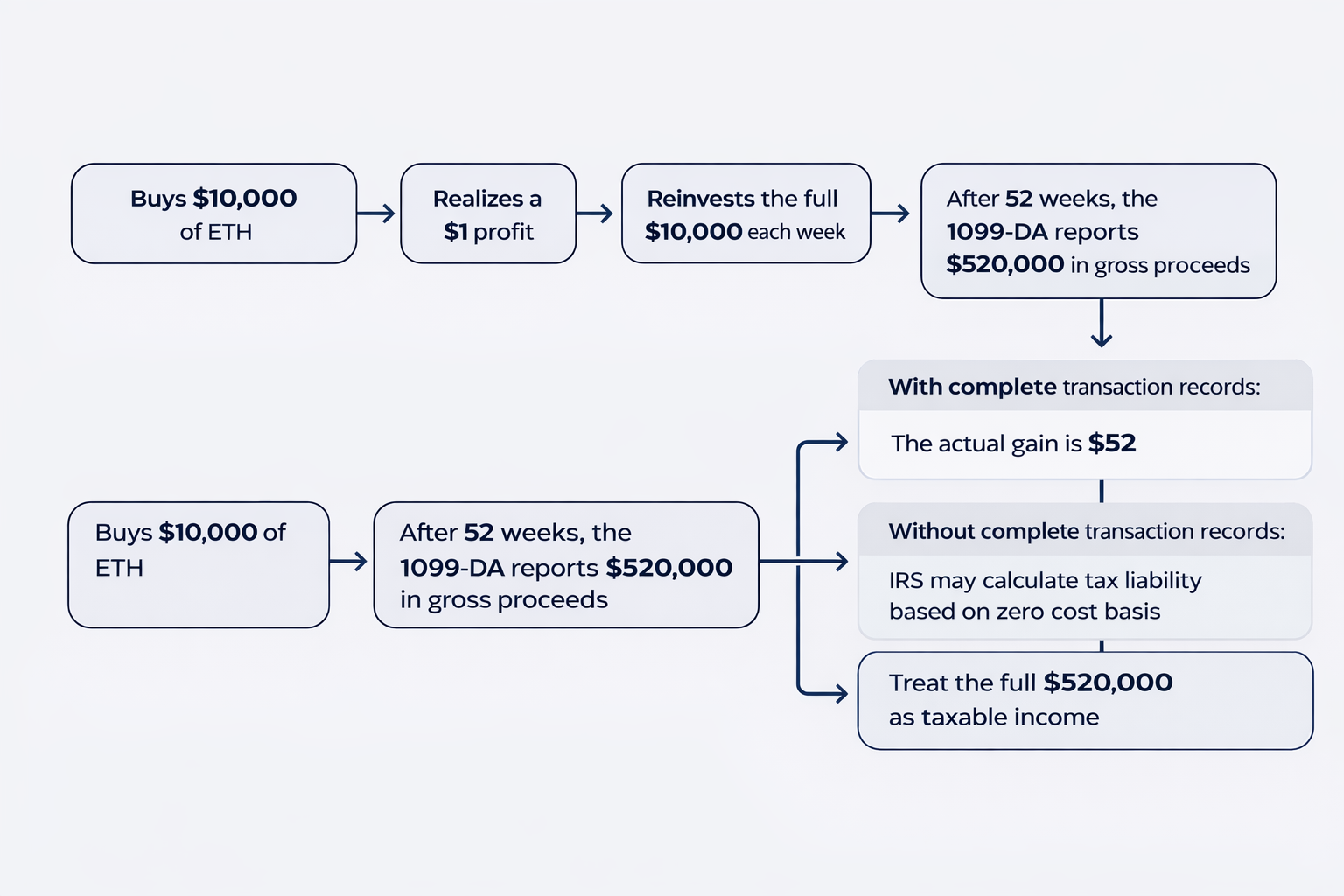

For the 2025 tax year, exchanges will report gross proceeds only. Cost basis will not be included.

What Happens If You Don't Report Your 1099-DA

If your tax return omits transactions shown on Form 1099-DA, the IRS may issue a CP2000 Notice. This notice proposes additional tax based on the unreported amounts.

You must report all 1099-DA information on your tax return, even if you believe the form contains errors. Discrepancies can be addressed through proper documentation and, if necessary, amended returns.

PART 2: UNDERSTANDING YOUR REPORTING OBLIGATIONS

Section 2.1: FBAR Compliance for Crypto Holders

Do you need to file? You must file an FBAR if the total value of all foreign financial accounts exceeds $10,000 at any time during the calendar year.

What is FBAR? The Foreign Bank Account Report (FBAR), officially FinCEN Form 114, is a compliance document for individuals with foreign financial interests. The form is managed by the IRS on behalf of the Financial Crimes Enforcement Network (FinCEN).

Filing threshold: The $10,000 threshold is based on the aggregate value of multiple accounts, not a single account.

Why FBAR Is a Powerful Enforcement Tool: U.S. anti-money laundering (AML) laws require U.S. persons to report maximum balances held at foreign financial institutions. Failure to report these balances is subject to substantial penalties.

Reporting maximum balances held at any time during the year is relatively quick and easy for the IRS to prove or disprove. This makes FBAR a powerful enforcement tool.

The penalties can be assessed regardless of whether you reported your crypto income on your tax return. These are separate violations.

Section 2.2: FATCA and Form 8938 Requirements

Do you need to file Form 8938? If your foreign financial assets exceed IRS reporting thresholds (commonly $50,000 for single filers, higher for married couples), you must file Form 8938 with your tax return.

What is FATCA? The Foreign Account Tax Compliance Act (FATCA), enacted in 2010, requires many taxpayers to report specified foreign financial assets on Form 8938. This includes accounts at foreign cryptocurrency exchanges.

Penalties for Non-Compliance: Form 8938 itself does not create tax liability. However, failure to file triggers serious consequences:

- $10,000 penalty for not filing Form 8938 with your original tax return

- $50,000 maximum penalty for continued failure to file after IRS notification

- Indefinitely open statute of limitations on your entire tax return until Form 8938 is filed

- 40% accuracy penalty on any additional tax related to undisclosed foreign assets

- Potential criminal penalties in cases of willful non-compliance

The statute of limitations risk: For early cryptocurrency investors with significant gains, the suspended statute of limitations poses the greatest long-term exposure. The IRS can audit any year for which Form 8938 was not filed, regardless of how much time has passed.

Section 2.3: Statute of Limitations and Audit Windows

The statute of limitations determines how long the IRS can audit your tax return and assess additional taxes.

Standard audit window: The IRS has three years from the date you filed to audit your return and assess additional tax.

Extended audit window: If you substantially underreported income (defined as underreporting by 25% or more), the statute extends to six years.

How crypto traders trigger the extended statute:

- Recall the earlier example of a trader who starts with $10,000 and executes weekly trades for a $1 profit each week. The actual annual gain is $52.

- The IRS calculates Total Positive Income (TPI) by adding all sale proceeds. In this example, the IRS sees over $500,000 in proceeds. If the tax return only reports $52 without accounting for the full transaction history, the IRS may conclude you failed to report $490,948 in income, well above the 25% substantial underreporting threshold.

- Proper reporting requires documenting each transaction's cost basis and proceeds, demonstrating how the $500,000 in proceeds resulted in only $52 in net gain.

No statute of limitations for fraud: If the IRS determines fraud occurred, there is no time limit. The agency can audit any year, including years for which you did not file a return.

Section 2.4: Total Positive Income (TPI) and Audit Risk

What is TPI? Total Positive Income (TPI) represents the sum of all sale proceeds without deducting costs or expenses. For IRS audit risk assessment, TPI is the relevant metric, not net income.

How TPI applies to crypto traders: Each time you exchange cryptocurrency for another asset (whether another cryptocurrency, stablecoin, or fiat), the IRS records the sale proceeds. Your cost basis is irrelevant to the TPI calculation.

For high-frequency traders, TPI can reach millions of dollars even when actual profit is minimal or negative. TPI is always positive, even in years when you experienced net losses.

The $400,000 Threshold Misunderstanding: The IRS has stated it will not increase audit rates for taxpayers earning under $400,000. This statement is misleading for cryptocurrency traders.

Most people interpret "income" as net income or adjusted gross income. The IRS uses Total Positive Income for audit targeting purposes.

For cryptocurrency transactions, this means the IRS examines gross sale proceeds, not realized gains. A trader with high transaction volume but minimal actual profit may exceed the $400,000 TPI threshold and face elevated audit risk despite reporting a small net gain or even a loss.

PART 3: GETTING AND STAYING COMPLIANT

Section 3.1: If You Haven't Reported Crypto in Past Years

Many crypto traders face a compliance gap they didn't intend to create. What started as a small position grew into significant gains, and filing became more complicated each year. The tax liability increased. Time passed.

Understanding how to return to compliance safely requires a clear strategy and proper timing.

Filing Strategy: Start with the Current Year

The most common approach is to file an accurate, complete return for the most recent tax year. This establishes a compliant baseline going forward.

Calculate your crypto gains for the prior six years as well, even if you don't file them immediately. This ensures consistency across all returns and prevents discrepancies if you later file or amend prior years.

A common concern: Won't the IRS question why previous years weren't filed? The electronic filing system accepts returns as submitted without triggering automatic inquiries about prior years. This concern should not prevent you from establishing compliance.

Prepare Past Returns in Advance

Even if you're not ready to file prior years immediately, prepare those returns now. If the IRS initiates contact or your account transcript shows unusual activity, you may need to respond quickly.

Having prior year returns calculated and ready strengthens your position and allows for faster response times.

Why Ongoing Monitoring Matters

The IRS typically flags returns for audit 6 to 12 months before assigning an examiner. During this window, your account transcript may show indicators that a return has been selected for review.

Regular monitoring of your IRS account transcripts can reveal:

- Discrepancies between reported income and third-party information reports

- Returns flagged for future audit before formal contact begins

- Changes to your account that may require immediate response

Early detection provides time to address issues, file amended returns if necessary, or prepare documentation before an audit formally begins. In some cases, proactive correction can prevent the audit entirely or reduce penalties.

Tax Shield by CryptoTaxAudit provides this type of continuous monitoring through a low-cost monthly subscription designed for everyday crypto traders. The service monitors IRS transcripts across all tax years and alerts you to changes that may require action, providing ongoing protection and peace of mind as you navigate compliance.

Secure Your Transaction Records

The burden of recordkeeping falls on the taxpayer. Exchanges may shut down, delete historical data, or become inaccessible. The IRS will not accept missing data as justification for incomplete reporting.

Backup your complete transaction history from every exchange and platform you've used. Maintain a secure copy and document all wallet addresses associated with your activity.

What to Do If You Received an IRS Crypto Notice

If you've received an IRS notice regarding unreported cryptocurrency (including Letters 6173, 6174, or 6174-A), see our guide: Understanding IRS Crypto Tax Notices and How to Respond.

Key Compliance Points Every Crypto Trader Should Understand:

- Form 1099-DA reports gross proceeds only for the 2025 tax year. You must document your cost basis separately to prove actual gains.

- FBAR filing is required if the aggregate value of foreign financial accounts exceeds $10,000 at any point during the year. Penalties apply regardless of whether you reported crypto income correctly.

- Total Positive Income (TPI), not net income, determines IRS audit targeting. High transaction volume can exceed the $400,000 threshold even with minimal actual profit.

- Substantially underreporting income by 25% or more extends the audit statute from 3 years to 6 years. Crypto traders commonly trigger this through incomplete transaction reporting.

- The IRS flags returns 6 to 12 months before assigning an auditor. Early detection during this window can prevent audits or reduce penalties.

PART 4: PROTECTION AND PROFESSIONAL SERVICES

Section 4.1: Understanding Audit Defense

If the IRS initiates an audit, the timeline typically extends two to four years from initial contact to resolution.

Crypto audits require recalculating transaction histories, documenting cost basis for thousands of trades, and challenging the IRS's proposed adjustments.

Initial representation often requires $10,000 to $50,000 upfront. Total defense costs can exceed $150,000 for cases that proceed through examination, appeals, or Tax Court. Most taxpayers significantly underestimate both the duration and total expense involved.

The Proactive Approach

The most effective audit defense begins before the IRS makes contact. The agency typically flags returns for audit 6 to 12 months before assigning an examiner. During this window, early detection and correction can prevent the audit entirely or significantly reduce penalties.

Tax Shield by CryptoTaxAudit provides this proactive protection through continuous IRS account monitoring and full audit representation coverage. Designed as an accessible entry point for crypto traders

Tax Shield includes:

- ✓ Continuous monitoring of IRS transcripts across all tax years

- ✓ Initial risk review to identify potential compliance issues

✓ IRS audit representation if an examination begins

✓ Letter review and response for IRS notices

✓ FBAR filing assistance

✓ Ongoing support from crypto tax specialists

Unlike reactive audit defense (which can cost $10,000-$50,000 upfront when the IRS makes contact), Tax Shield provides ongoing protection through a monthly subscription. This approach allows traders to stay ahead of IRS scrutiny rather than scrambling after receiving an audit notice.

Section 4.2: Professional Tax Preparation and Gain Calculation

DIY crypto tax software serves a specific purpose. For investors who buy and hold a few assets on one or two U.S. exchanges, these tools can generate adequate results.

However, certain situations require professional expertise:

- Complex transaction histories: High-frequency traders, DeFi participants, and those using multiple exchanges face calculation challenges that automated software often cannot resolve accurately. Transaction volumes in the thousands or millions require specialized reconciliation methods.

- Foreign exchange activity: Accounts at non-U.S. exchanges trigger FBAR and FATCA reporting requirements beyond standard tax return preparation. Missing these filings creates penalties separate from any tax liability.

- Advanced DeFi protocols: Liquidity pools, yield farming, staking rewards, and wrapped tokens involve tax treatment questions that remain unsettled or poorly documented. Incorrect classification can result in substantial overpayment or underreporting.

- Compliance gaps from prior years: Returning to compliance after periods of non-filing requires strategic planning. The approach differs significantly from routine annual filing.

CryptoTaxAudit Services

Crypto gain calculation: Accurate calculation of taxable gains across all transaction types, including complex DeFi activity, high-volume trading, and multi-year reconciliation. This service works as a standalone calculation or integrates with your existing tax preparation.

Tax return preparation: Complete tax return preparation using methods designed to withstand IRS scrutiny. This includes proper reporting of all digital asset income, required disclosure statements, and FBAR/FATCA compliance where applicable.

For more information: Crypto Gain Calculation Services | Tax Return Preparation