How to Get Compliant After Missing Crypto Taxes: CryptoTaxAudit's IRS Defense Strategy

Key Takeaways:

- Proactive IRS monitoring can flag audit risks 1-6 months before formal examination begins.

- Filing the current year correctly while preparing past returns creates a credible path back to compliance.

- The average crypto audit takes 15 months and can cost over $150,000 to defend without a defense plan.

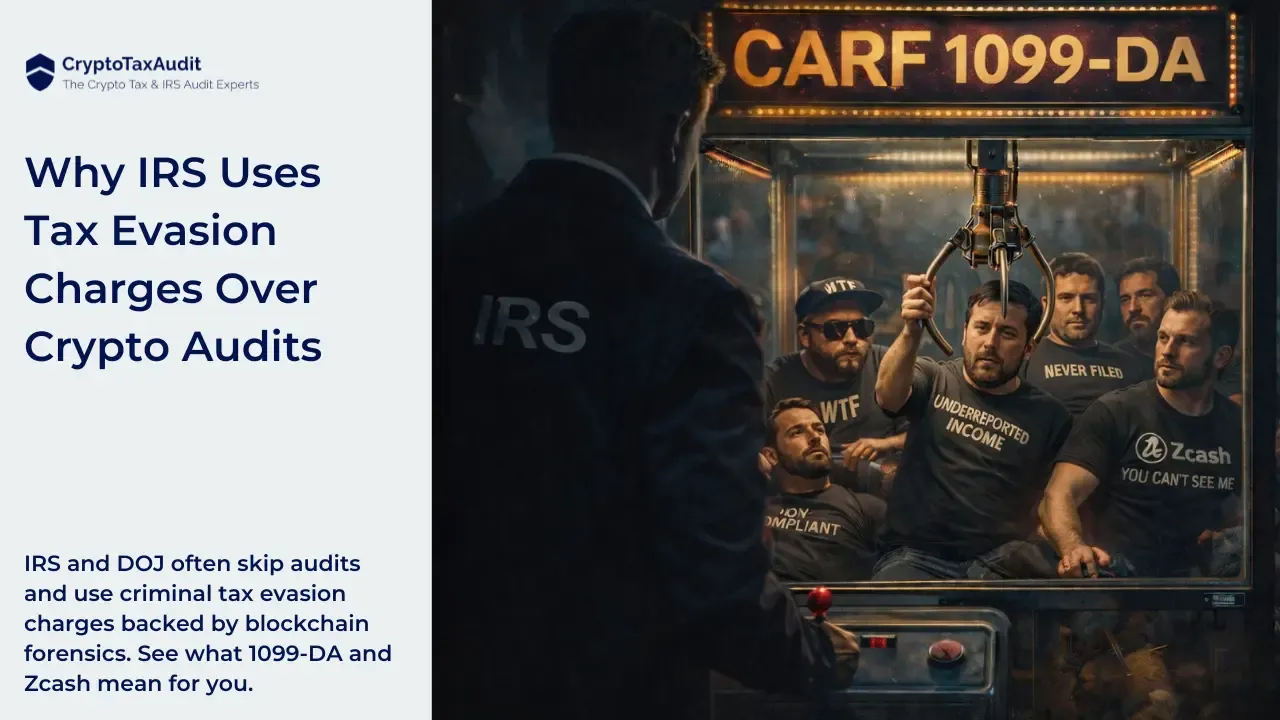

- Criminal enforcement is faster and cheaper for the IRS than traditional audits, making early action critical.

What if you didn’t report your crypto taxes correctly?

Your crypto tax situation might feel out of control. You have years of crypto transactions spread across multiple exchanges.

Some of those platforms have shut down. You cashed out six figures.

Now you are trying to calculate your cost basis, and you have no records.

This article is for you if you own crypto and are not sure you reported it correctly to the IRS.

Maybe you traded and did not track your gains.

Maybe you swapped coins and did not realize that triggered taxes.

Maybe you did not know you had to report crypto at all.

This article is to help you take your first steps toward compliance.

Why Do Crypto Tax Audits Take So Long?

The fear of an audit's results causes financial anxiety, marital strife, divorce, employment issues, and prolonged health effects from stress.

The average audit takes about 15 months. The audit process is intricate. It often demands detailed financial records and adherence to specific reporting requirements.

If you challenge the auditor's assessment, an appeal to the U.S. Tax Court is often necessary.

That can take another two years to resolve.

How Far Back Can the IRS Audit Crypto Taxes?

The IRS has an increased focus on digital assets.

It is expected they will send many warning letters to notify taxpayers about potential discrepancies over the next few years.

The statutes of limitation provide some comfort.

After the return is filed, the IRS has only three years to assess additional taxes.

They get six years to assess if you underreport your income by 25%.

If they can assert the taxpayer intentionally falsified the tax return (fraud), there is no statute of limitation protection.

How Do You Get Back in Compliance After Missing Crypto Taxes?

For many, paying taxes on past gains (which may have evaporated during a bear market) is more than they can afford.

They want to get back to compliance but don't know how.

Here is an approach many have used to transition to compliance under the radar, so to speak.

Step 1: Back Up All Crypto Transaction Records Now

The tax code places the burden of record-keeping on you.

If an exchange shuts down or deletes your history, the IRS won't accept "I lost my data" as an excuse.

Back up your full transaction history from all exchanges. Store a secure copy. Keep a list of all your wallet addresses.

Step 2: Prepare Past Returns for Quick Filing When Needed

Even if you're not ready to file past years yet, be prepared to act quickly.

If our monitoring service flags an IRS audit or transcript change, you may need to file or amend a return fast.

Having prior years ready puts you in a stronger position.

At least have them reviewed.

Step 3: Set Up IRS Account Monitoring Before an Audit Starts

Continual monitoring of your IRS accounts is critical to protecting yourself.

Monitoring your IRS accounts allows you to detect under-reporting of income.

That's a common cause of audits.

The monitoring can also see when a tax year is flagged for an audit. This happens one to six months before the formal start of an audit.

That gives you time to correct issues.

You can avoid accuracy penalties or even the entire audit.

These two indicators alone can keep you from getting in the crosshairs of an IRS audit.

This protection is available through our Tax Shield Full Defense membership.

We monitor your IRS accounts continuously and can see when the IRS flags you for an audit, sometimes more than six months before they send you a notice.

What’s included:

Step 4: File Your Current Year Tax Return Correctly

Start by accurately preparing a return reporting all your crypto income for the latest year's return.

This return will be compliant.

The prior year's returns will age beyond the statute of limitations by continuing to file honest returns in subsequent years.

You should recalculate your crypto gains for the prior six years.

That way the gains reported in the latest year's return will be consistent with prior returns if you file them in the future.

A common concern taxpayers have with this strategy is thinking that if they file this year, the IRS will wonder why they didn't report crypto gains in prior years.

The electronic filing system doesn't ask these questions. The IRS accepts returns as filed.

Don't let this concern paralyze you.

Step 5: Have an IRS audit strategy.

The start of an audit is terrifying. You're suddenly scrambling.

Should you hire a lawyer?

A CPA?

A crypto tax expert?

Most professionals understate how long an audit will take. They also understate how expensive it will be to fight back.

Defending a crypto audit the right way means recalculating thousands of transactions.

It means challenging the IRS's gain calculations.

Sometimes it means petitioning the Tax Court.

This process can drag out over two to four years. It's not uncommon for total defense costs to exceed $150,000.

Tax Shield Full Defense gives you early warning through continuous IRS monitoring.

If an audit escalates or you need full representation, that’s when monitoring alone isn’t enough. Those situations require hands-on defense and direct representation.

That’s when you should speak with our Client Solutions Manager to understand what level of support makes sense for your situation.

Some cases require full audit defense, including representation through Tax Court and coverage of defense costs.

In many of the audits we take on, the outcome includes corrections in the taxpayer’s favor, including refunds where the IRS got it wrong.

How to Prepare for IRS Form 1099-DA Reporting in 2026

Starting in 2026, exchanges report every crypto sale to the IRS on Form 1099-DA. That means the IRS has your transaction data before you file.

If your records don't match what the exchanges reported, the IRS will know.

Tax Shield monitors your account so you see audit flags before before a notice goes out.

Don't wait for the IRS to contact you. Get Tax Shield and see what they see first.